Recalculation of child support and spousal support

Child support recalculation

You recalculate child support annually based on the paying parent's current income tax information so that payments stay in line with the laws and your agreement. Most provinces offer online tools such as a child support calculator to help you recalculate based on the Federal Child Support and Spousal Support guidelines, which have been fully adopted to calculate child support in Canada.

You recalculate child support annually based on the paying parent's current income tax information so that payments stay in line with the laws and your agreement. Most provinces offer online tools such as a child support calculator to help you recalculate based on the Federal Child Support and Spousal Support guidelines, which have been fully adopted to calculate child support in Canada.

Once support calculations are updated, you can apply them to splitting extraordinary expenses pro rata.

Since the guidelines are straightforward, this begs the question of why there can be so much conflict around these payments. The answer is in the calculation of income. Income is made up of several components, including:

- Base Income

- Dividends

- Bonuses

- Stock options

- Interest Income

- Self-employed

The calculation is relatively easy for someone with a straightforward T4, but when there is more, it can be complex.

It's important to note that child custody arrangements can significantly impact support calculations. In cases of shared custody or split custody, where each parent has the child for at least 40% of the time, the child support obligation may be adjusted accordingly.

Our goal at Fairway is to help parents keep child support payment levels in line with their income so that families can avoid the time and expense of asking the courts to review their child support orders.

Spousal or alimony support calculator

Most separation agreements will set out the terms regarding spousal support, also known as alimony in detail. The need for recalculation depends on your specific terms. If your spousal support was either a lump sum or fixed payments over a fixed term, there is typically no payment variability. However, some agreements may include provisions for recalculation in case of significant changes in annual income or simply as a matter of time.

Most separation agreements will set out the terms regarding spousal support, also known as alimony in detail. The need for recalculation depends on your specific terms. If your spousal support was either a lump sum or fixed payments over a fixed term, there is typically no payment variability. However, some agreements may include provisions for recalculation in case of significant changes in annual income or simply as a matter of time.

The more common type of spousal support is variable. Your agreement may set out the equation for determining future spousal support payments or have left it blank. Since the calculation and payments around spousal support are not black-and-white and are often an area of contention, it’s best to seek assistance for recalculations.

Depending on the length of the marriage and other factors outlined in the spousal support advisory guidelines, support can continue indefinitely or for some shorter length of time. The spousal support calculation will often consider factors such as the income difference between spouses, the presence of a dependent child, and each spouse's ability to become self-sufficient (known as the self-support reserve).

Additional considerations

During the recalculation process, it's important to consider other aspects of your separation or divorce, such as:

- Property division

- Financial support for extraordinary expenses

- Consumer protection issues related to joint debts or assets

At Fairway, we can help you get this done with little stress or cost

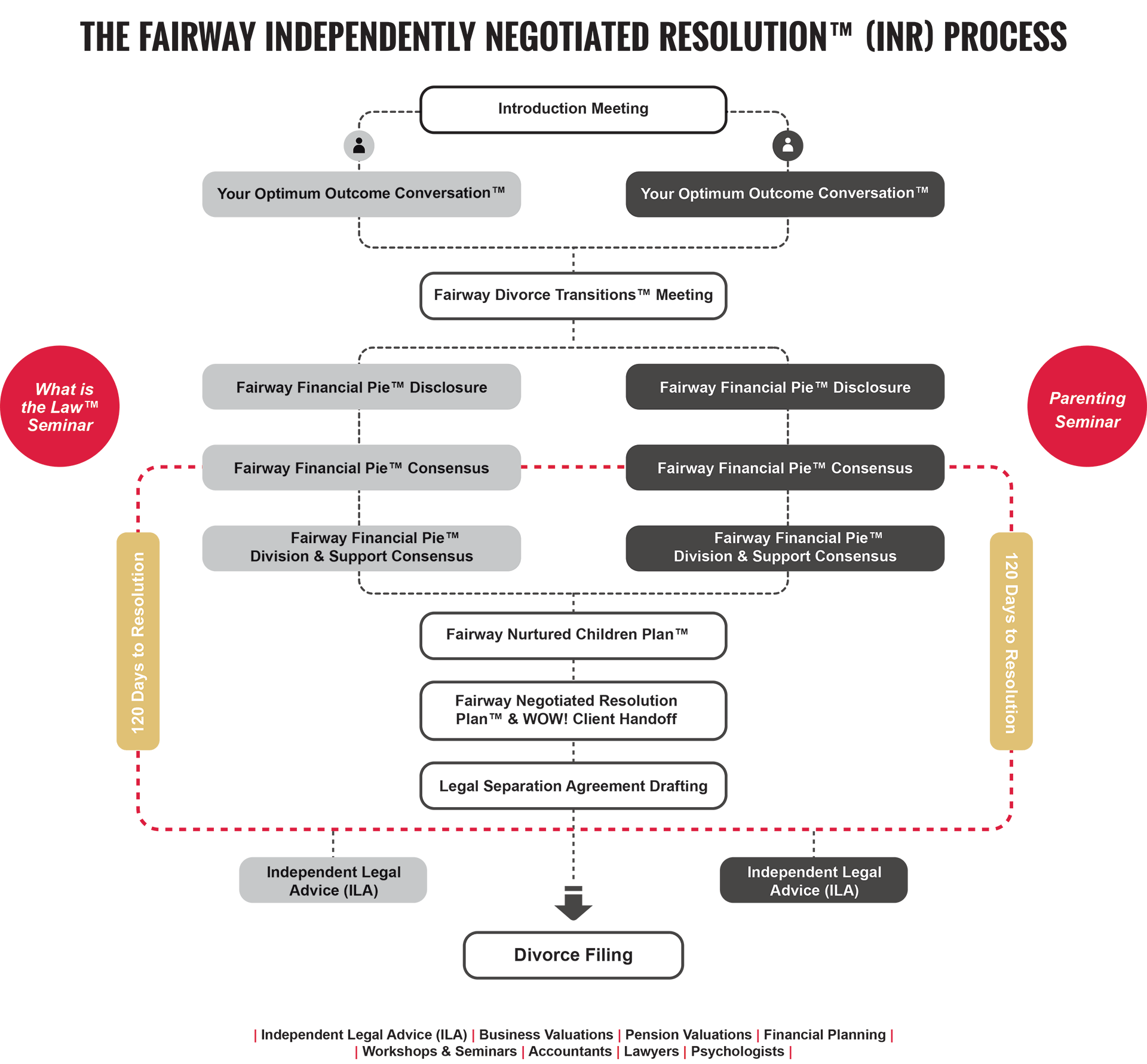

We strive to keep it easy, stress-free and inexpensive. The differences of opinion and approaches can result in stress and conflict. We use our proven Independently Negotiated Resolution (INR™) process so that each party can make decisions independently without emotional pressure.

We always ensure you are an informed and empowered decision-maker, even during recalculations of support. Our team of financial experts helps couples work through recalculations fairly, accurately, and cost-effectively.

The average cost of a separation/divorce in Canada is now over $51,000

Client testimonials

Success comes in many forms. For us, it is hearing back from our clients and reading how we have changed their lives for the better. These stories are the reason we do what we do.

I just want to say thank you to you and Tracy. I appreciate that your jobs are not always fun filled but you are both very professional and i am sincere in saying that i do appreciate the work that has been done on my behalf.

- Saskatoon Client January 2020

The Fairway Method

Divorce is difficult. We make is easier from start to finish. The Clear Road to a New Life®

Fairway Divorce Solutions meets your needs

Locations

Helping Canadians with divorce mediation since 2006, with more than 25 Divorce Resolution Mediators in more than 11 locations.

Head Office

Head Office

Manitoba

WinnipegAlberta

Airdrie Calgary Edmonton Southwest Edmonton Northwest Okotoks Red Deer Medicine Hat Edmonton East Lethbridge Sherwood Park Grande Prairie Fort McMurray Leduc Fort SaskatchewanOntario

Waterloo WellingtonSaskatchewan

SaskatoonFrequently asked questions

Fairway Divorce Solutions has an in-house legal team that drafts your separation agreement and, in certain provinces, can file for divorce. Also, our matrimonial lawyers educate divorcing couples during the What is the Law™ Seminar. You are also encouraged to get independent legal advice from lawyers.

It is seldom too late. Fairway Divorce Solutions has helped couples frustrated with the cost, time and emotional strain of using lawyers. The Fairway team encourages divorcing couples to research and understand divorce options and choose a process designed to meet the needs of both parties and the children. The court process can often be paused to allow parties to explore and use Alternative Dispute Resolutions (ADR) methods.

No, you do not need a lawyer to get divorced. However, it is highly recommended that a lawyer review your separation agreement before you sign it when children and assets are involved. Once you have a separation agreement, you do not need to use your lawyer to file for divorce. We offer divorce filing services in applicable provinces to make your life easier and keep costs down.

A divorce is a method of terminating a marriage between two individuals; your divorce will give each of you the legal right to marry someone else.